The Professor explains economics

using amusing pictures and illustrations.

You have arrived at www.whyitdoesnt.com

where The Professor is serious about economics but likes to joke and amuse.

He explains economics in 5 parts using wacky pictures.

PART 1 Hello and welcome

He shows how the economy works,

and why it doesn't. Why might the economy be functioning badly?

Though the economy is complex,

The Professor keeps it simple and explains just the bare bones.

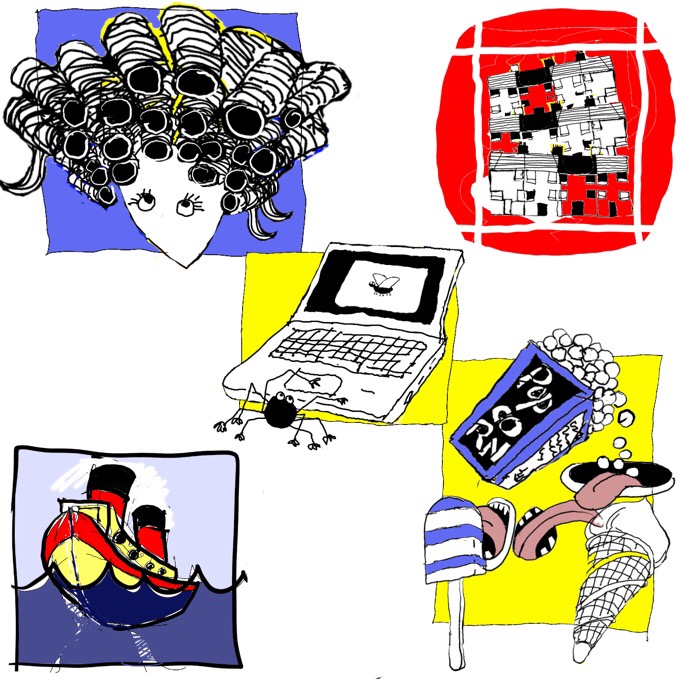

He says that services are provided such as nursing,

window cleaning and banking.

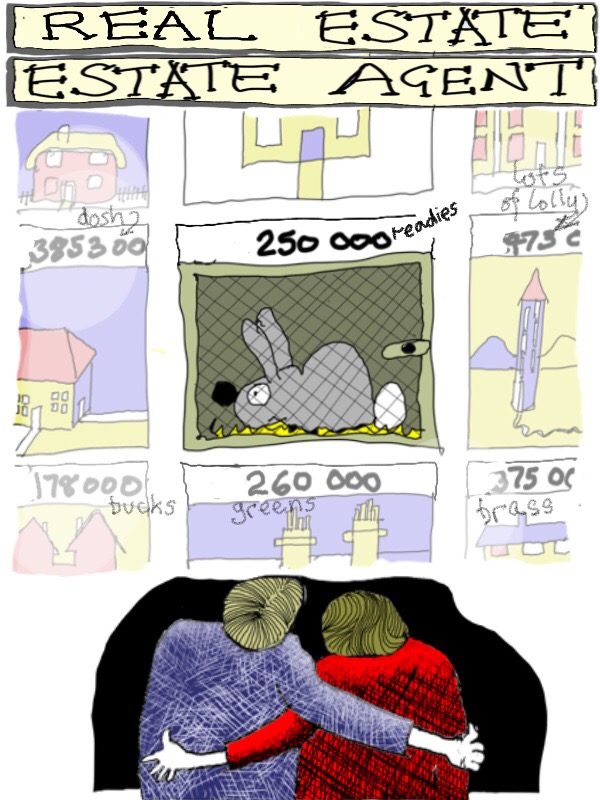

He says that stuff is made such as

hair curlers, houses, computers, ships, ice cream,

lollipops, popcorn and dog collars.

All of this stuff as well as services is OUTPUT.

How is all this OUTPUT financed?

By investors raising money.

Money is found to pay for workers' wages.

He says that money has also to be found

to pay for ingredients such as

wood, iron ore, chemicals and fertilizer.

On top of that money has to be found to pay for

factories and equipment needed for producing output.

Money has to be found for wages

which are kept as low as possible to boost profits.

This of course creates a conflict of interests.

Right wing economists might be surprised that their hero Adam Smith (1723-1790)

wrote the following:

The labour and time of the poor is in civilised countries

sacrificed to the maintaining of the rich in ease and luxury.

The Landlord is maintained in idleness and luxury by the labour of his tenants.

The moneyed man is supported by his extractions from the industrious merchant

and the needy who are obliged to support him

in ease by a return for the use of his money.

While it is work that creates wealth,

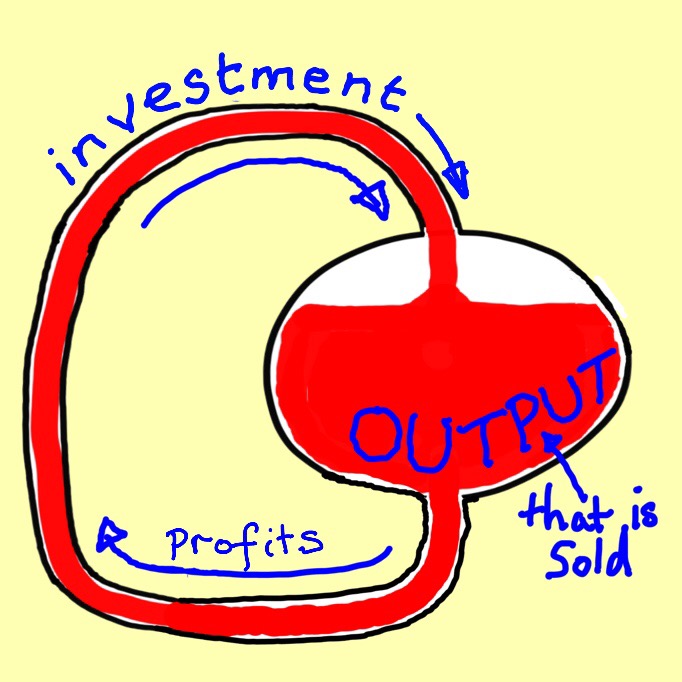

output requires an initial investment and ......

Output is sold ............

.............. making a profit.

Profits are reinvested with the aim of

making more profit if things go well.

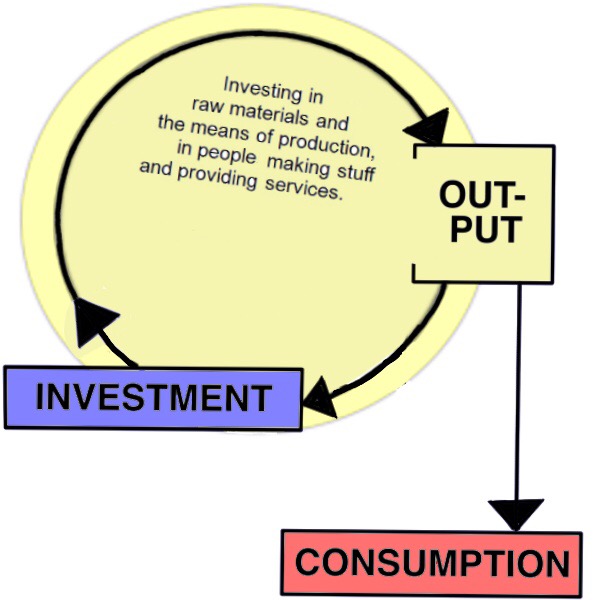

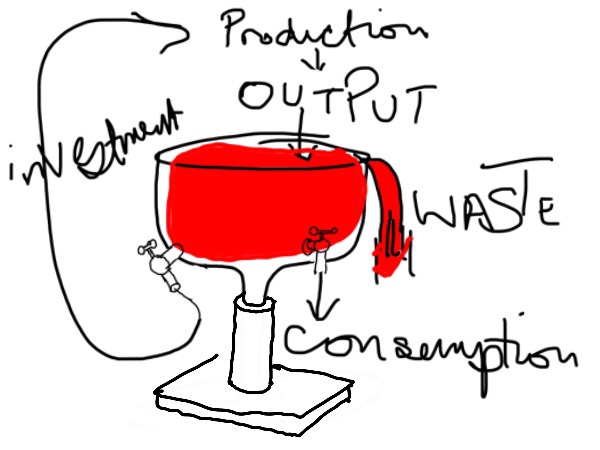

Round and round

INVESTMENTS produce OUTPUT

which is SOLD,

making PROFITS

which are then INVESTED,

which produces OUTPUT

which is SOLD

making PROFITS

which are INVESTED,

etc.

There is a flow round the economy.

Congratulations for getting this far.

You now understand the basics of the circle of production.

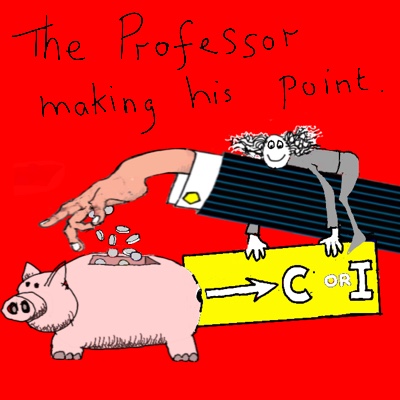

PART 2 Output

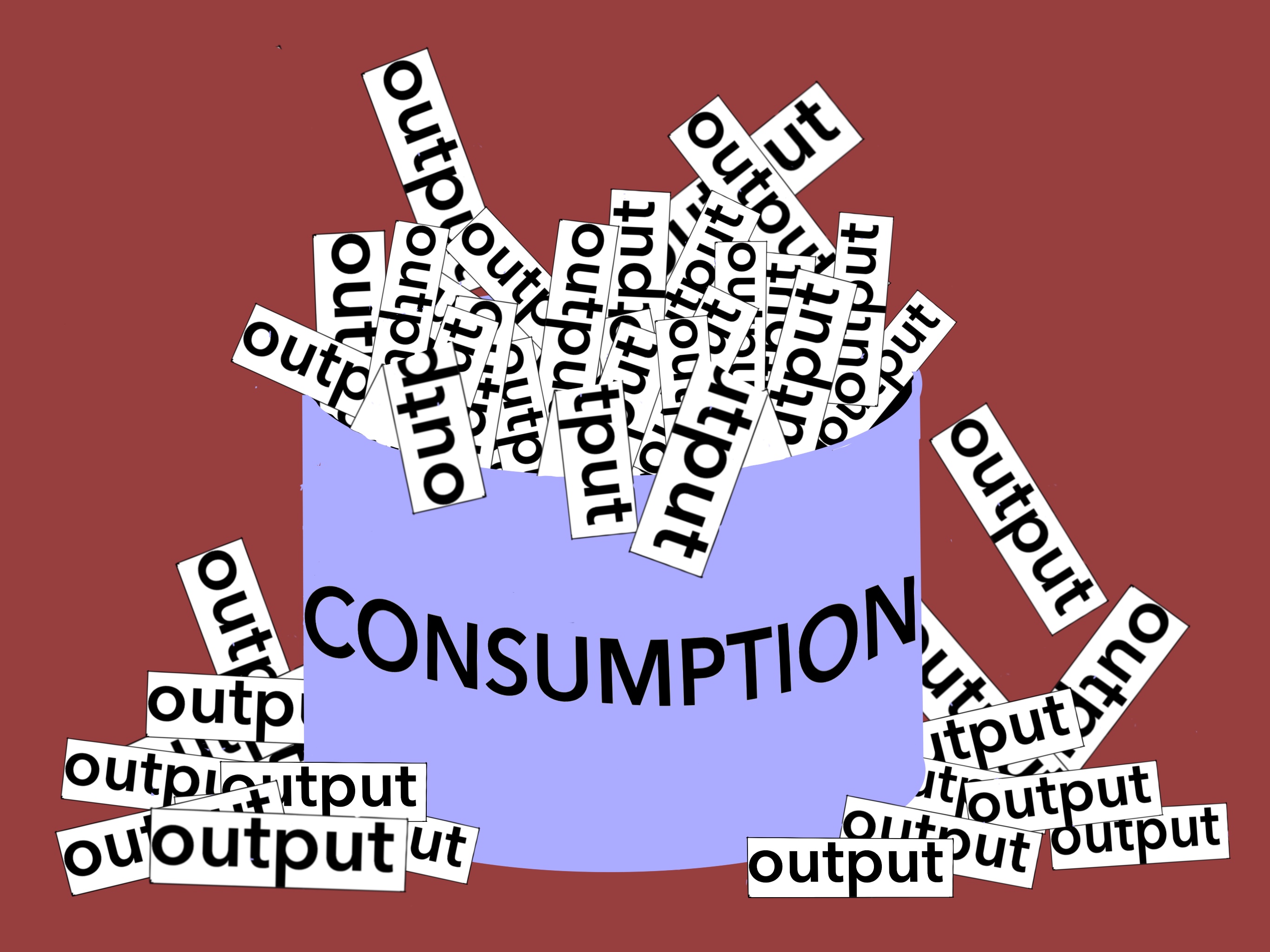

HOW IS OUTPUT USED?

The grain could also be stored away in a barn.

However it must eventually be

CONSUMED or INVESTED.

There is no other choice.

The saved grain, in the end, gets eaten or sown, unless it rots.

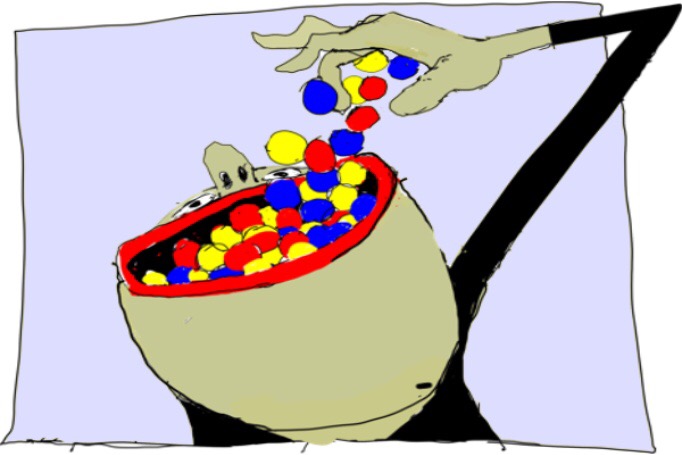

Output can be consumed.

Output can be invested.

Some output can be bought and then used to make more output.

The output that is bought, such as factories, buildings, mined raw materials and equipment, are investments.

The money used to pay for them is also seen as an investment

The Professor says that OUTPUT must be one or the other,

But what about savings?

They get recycled back into the economy by the banks and other financial institutions,

when they are lent out again for consumption or investment.

Banks even lend out more than

they take in as deposits.

They generate new money!

But that is a different story.

Round and round. Investment, output, consumption and more investment.

The flow round the economy should all work well.

But instead the economy is on life support

is this?

PART 3 Too much output

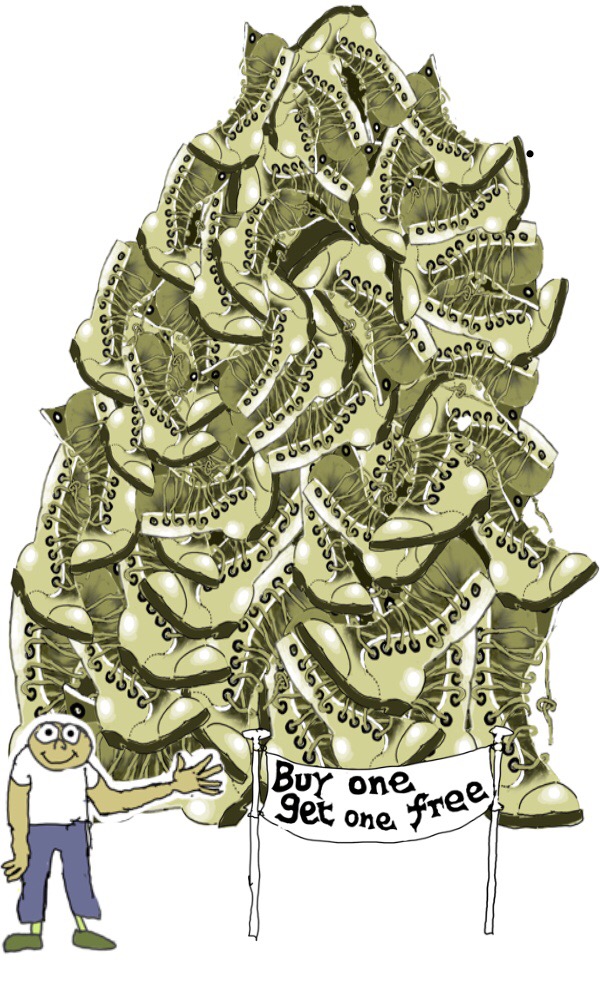

The problem is that there is too much global output,

too much production.

There is overproduction.

OK. Consider the following.

Output has increased dramatically due to science and modern technology,

for example.

Over the years, the world has accumulated

an enormous wealth of productive potential.

Take the case of car production.

Output is also increasing because firms must make more and sell more.

Otherwise they lose out to their competitors.

The result has been an enormous increase

in production and services

as output is heaped upon output driven by more and more investment.

The history of capitalism has been one of

extraordinary growth in wealth and increased living standards.

Investment has worked like magic.

Round and round

INVESTMENTS produce OUTPUT

which is SOLD,

making PROFITS

which are then INVESTED,

which produces OUTPUT

which is SOLD

making PROFITS

which are INVESTED,

etc.

there is a problem.

The global system has reached a new stage in its evolution.

It is now too successful for its own good at making stuff.

It produces TOO MUCH output.

The trouble is that the system

does not cater for those that cannot afford its output.

The system is driven by a search for profits.

That is its aim, its motivation and what it is.

It's existence is not to fulfil needs.

Though it can do so when it raises living standards as a by-product of its main goal.

Remember that the system is one of continuous circular motion.

INVESTMENTS produce OUTPUT

which is SOLD,

making PROFITS

which are then INVESTED,

which produces OUTPUT

which is SOLD

making PROFITS

which are INVESTED,

etc.

This fails when a link in the circuit gets broken.

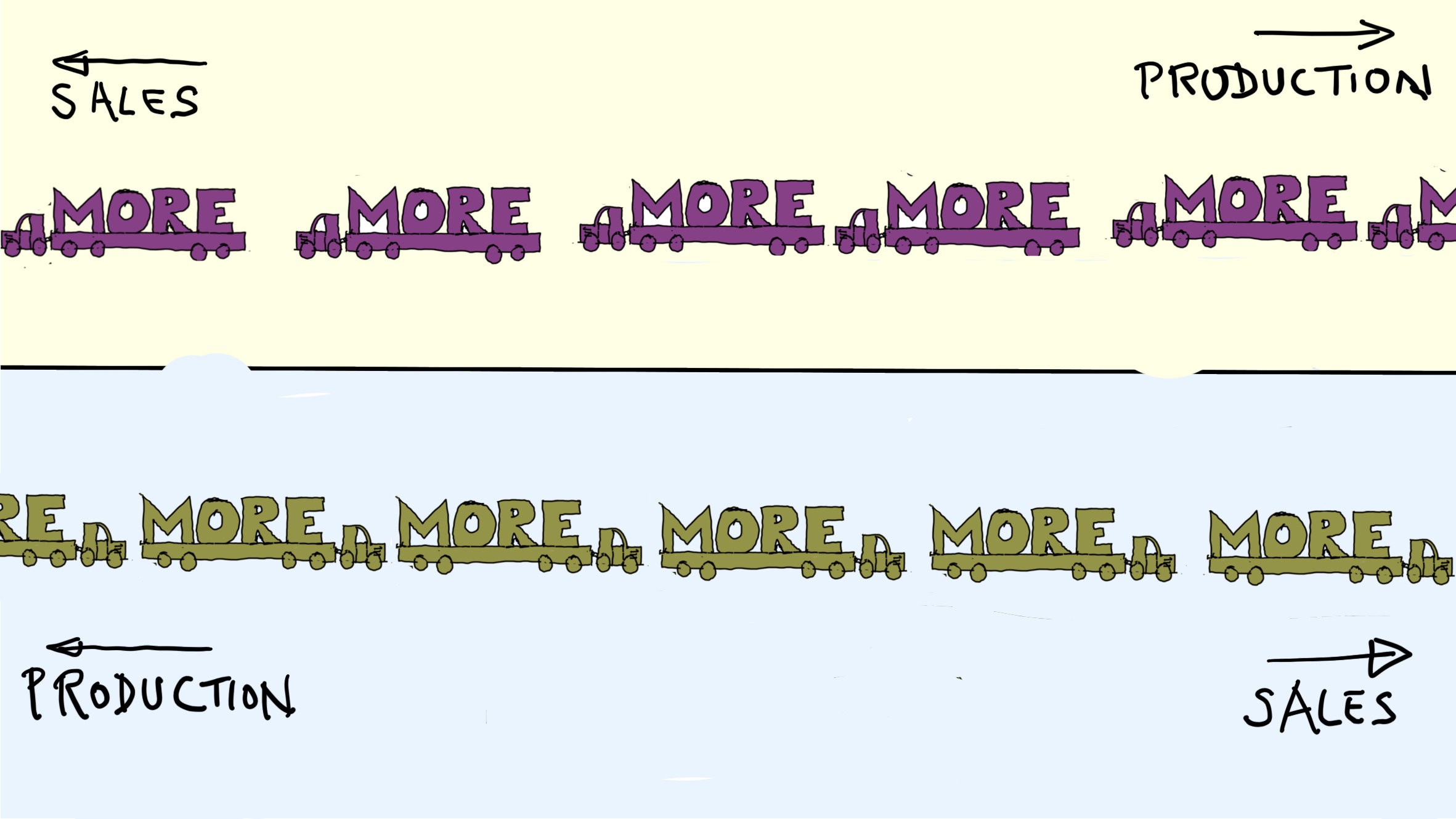

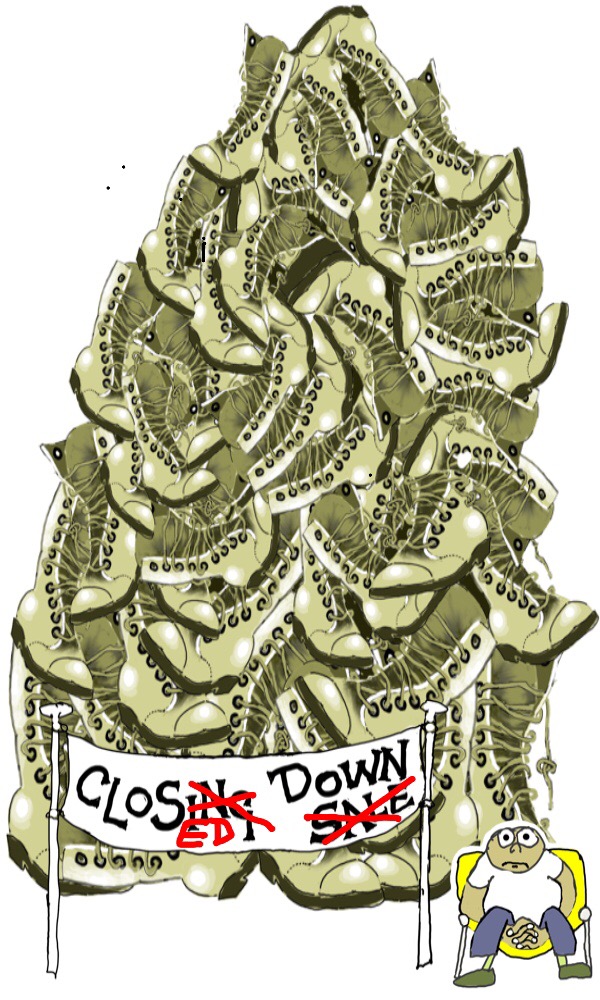

The system fails when output is greater than consumption.

This occurs when there is overproduction.

This occurs when there is overproduction.

Sales cannot keep up with output.

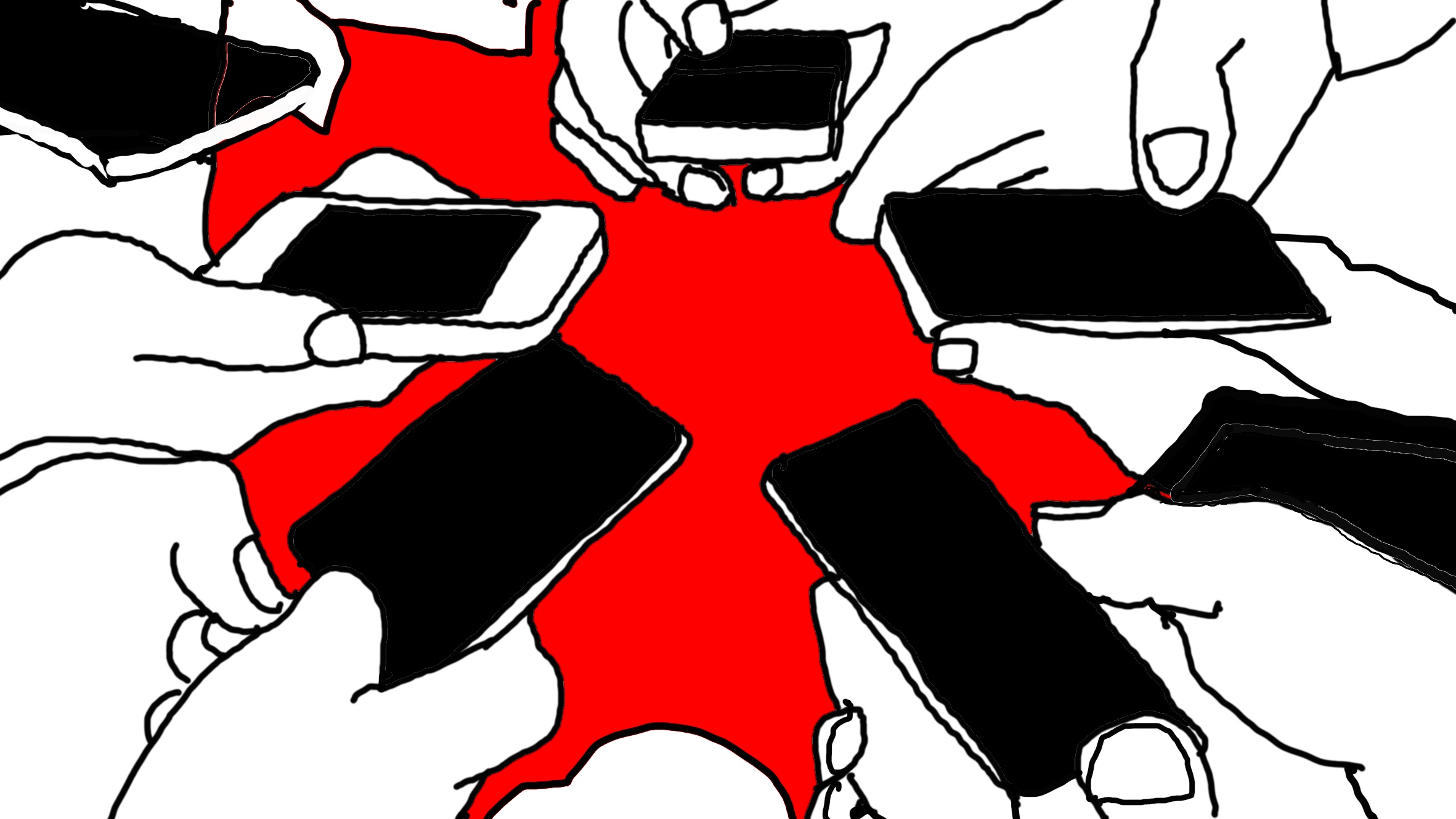

Take smart phones for example.

Take smart phones for example.

Sales are down when most people (who can afford one) already have a smart phone.

The system has the problem of how

to increase consumption to deal with the overproduction.

Advertising!

Society is dominated by advertising and this epitomises

Society is dominated by advertising and this epitomises

this era of consumerism.

Overproduction is a serious problem.

When there is substantial over capacity

new investment is risky and the economy stagnates.

When there is substantial over capacity

new investment is risky and the economy stagnates.

Government central banks then come to the rescue.

They set very low interest rates

Government central banks then come to the rescue.

They set very low interest rates

which encourages

borrowing for investment and consumption.

This spending helps boost the economy.

The downside is that very low interest rates encourage risky investments.

This makes the economy fragile and prone to crises.

The downside is that very low interest rates encourage risky investments.

This makes the economy fragile and prone to crises.

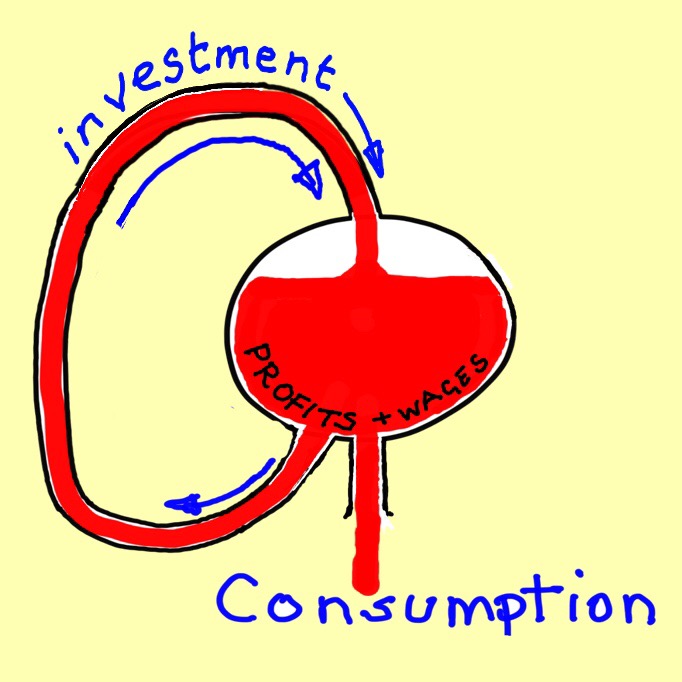

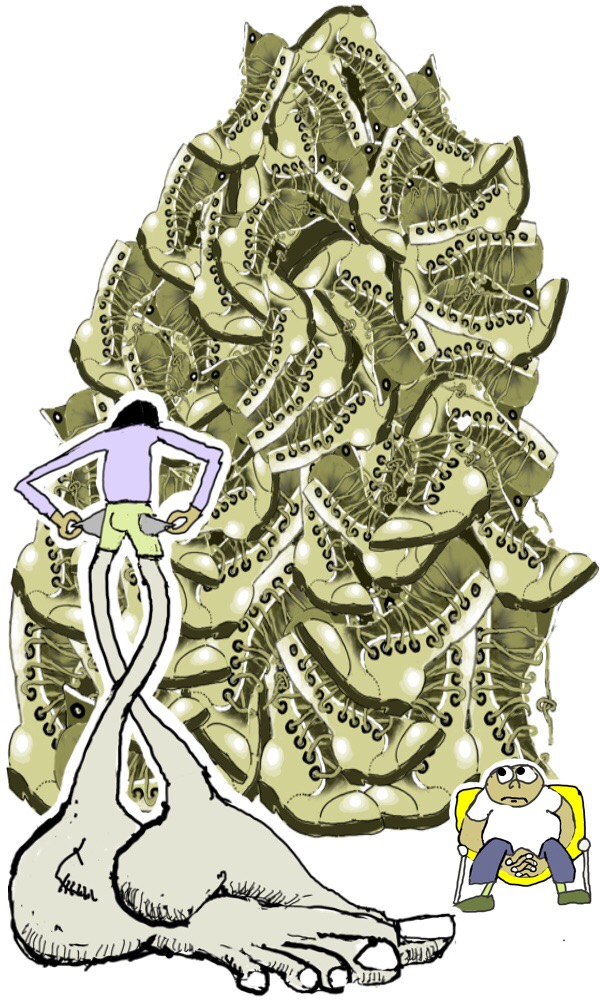

On top of this is inequality.

The 2019 Oxfam report said that the 26 richest people own as much as the poorest half of the world’s population.

The gulf between rich and poor is insane.

The gulf between rich and poor is insane.

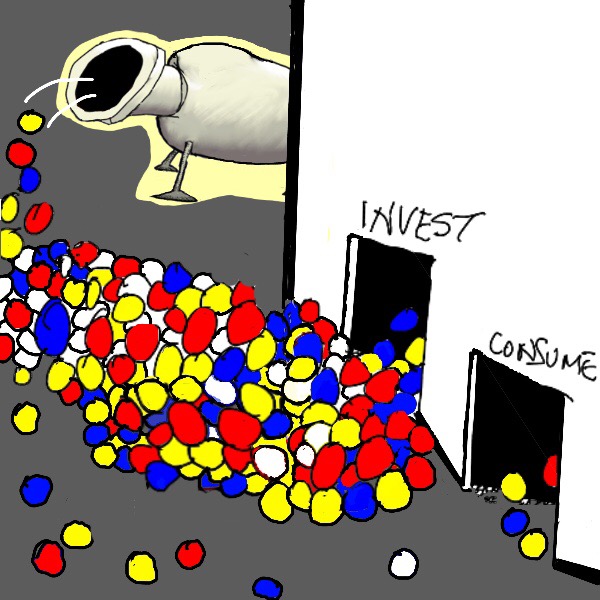

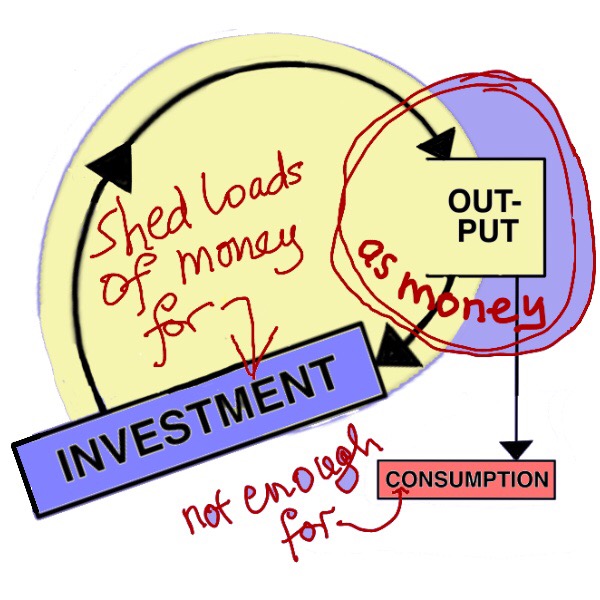

The rich have so much money

that there is a limit to

their CONSUMPTION.

The rich have everything that they could desire,

so they DON'T consume to the limit of their wealth.

They invest instead. Too much output is recycled to INVESTMENT ..............

...........and not enough to CONSUMPTION.

The very rich have no option but to INVEST

when they run out of

things and services to CONSUME.

What else can they do with their

SURPLUS WEALTH?

We live in a consumer society but too many people are unable to participate.

Most people do not have enough money

so sales suffer.

Too many people,

are in the position that

they CAN'T consume more.

Too much wealth is available for INVESTING

and not enough for CONSUMPTION.

There is OVERPRODUCTION

This is the problem with

the World Economy.

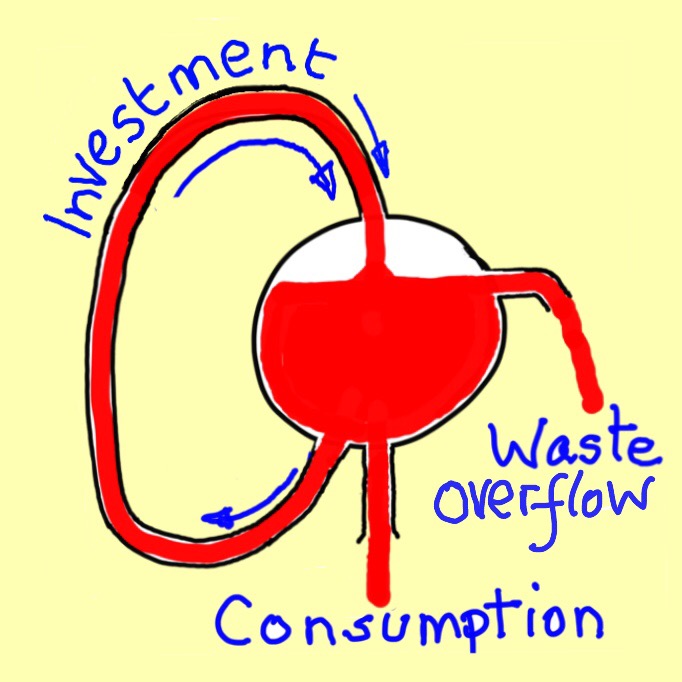

The flow round the economy looks like this, with too much going to waste.

More INVESTMENT leads to

more OUTPUT.

and when OUTPUT cannot be sold,

because of inadequate CONSUMPTION,

the OUTPUT goes to WASTE.

The waste is seen in stagnation, projects abandoned before completion, factories run below capacity and failed businesses.

It results in unemployment, the worst waste of all.

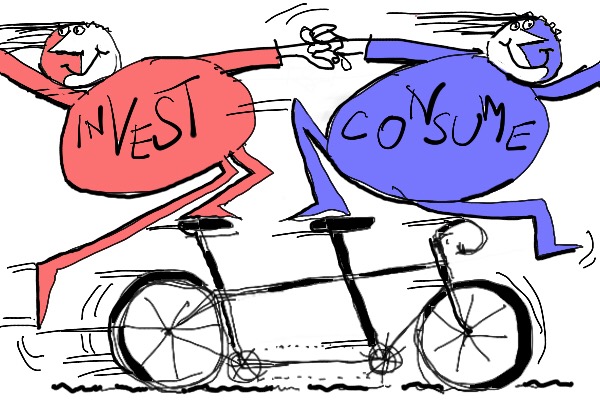

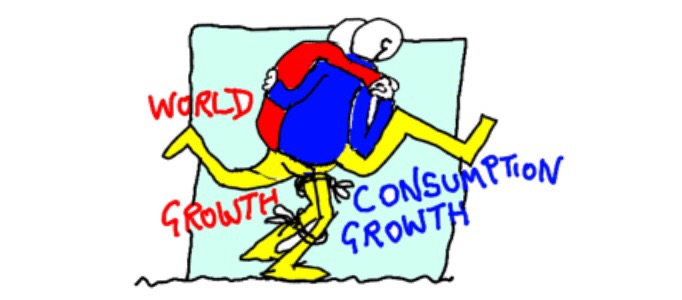

For the world economy to prosper

CONSUMPTION and INVESTMENT

have to increase in tandem

and be kept in the right proportion

to each other.

But this is seemingly impossible to achieve.

So the result is waste.

Continuous unrelenting waste is generated by the world economy.

More is produced than can be sold.

Waste is the inevitable result.

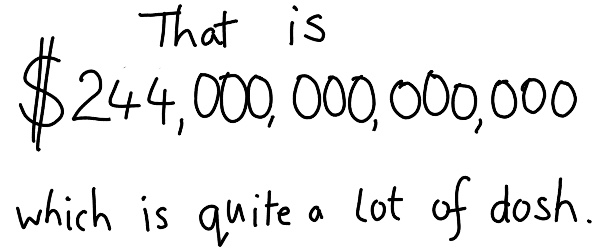

PART 4 Debt

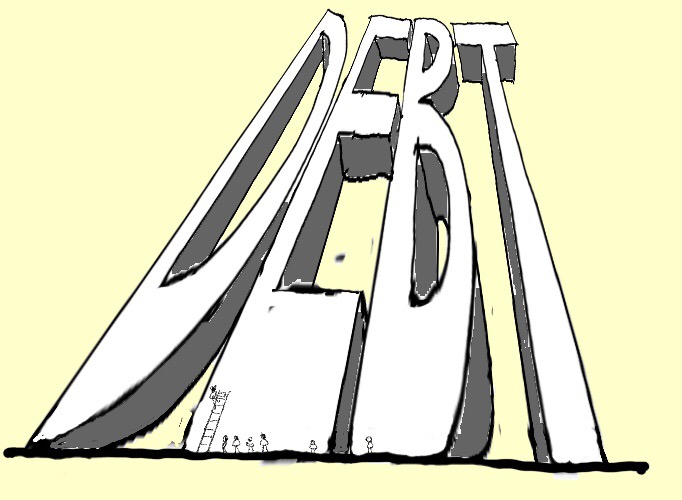

World debt has become absolutely huge and is growing.

Global debt has reached more than three times yearly world output.

Global debt has reached more than three times yearly world output.

World debt rose to a record of more than $244 trillion by the start of 2019.

This huge debt arises because of the enormous mountain of wealth that is owned by the big players.

Many giant corporations and multinational companies

have much more money than they need for investment.

They hold the money back.

Their huge unused funds are stashed away.

These large savings are then loaned out by banks and financial institutions as debt.

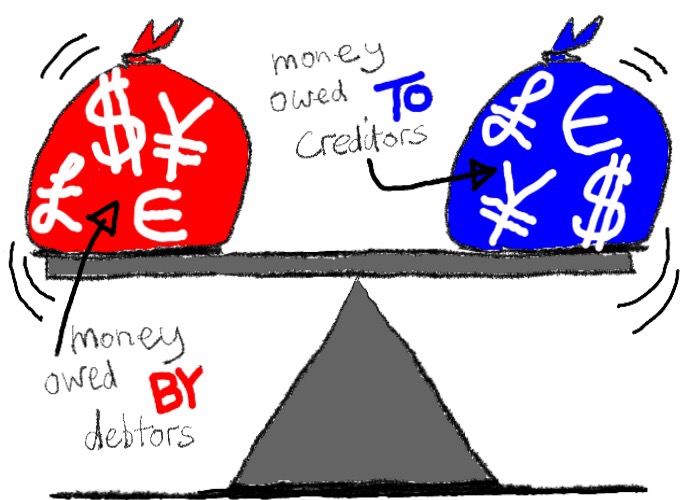

Debtors owe over $200 trillion. Debtors are not only the poor but also banks, companies or governments.

Debtors owe over $200 trillion. Wealthy creditors have over $200 trillion saved.

Debtors owe money that must be paid.

Creditors are owed the money.

Some owe money and are also owed money.

THE DANGER IS WHEN DEBTS CANNOT BE PAID

Excessive debts make the economy fragile,

so a small upset can spark a crisis.

They do so when economic growth is slow.

World growth is slow because it is tied to the growth in spending on consumption.

But why is slow growth such a problem?

It is a problem

if insufficient new wealth is produced

to pay off the debts.

Businesses, forced to pay debts, often have to sell off assets, as in a fire sale, at a loss.

Debts that cannot be paid will not be paid and then those that have made loans lose out.

In a complex integrated world....................

......................... where banks and others are both lenders and borrowers.....

......................... debts unpaid can, like falling dominoes, cascade through the system causing economic crises.

PART 5 End points

And the future?

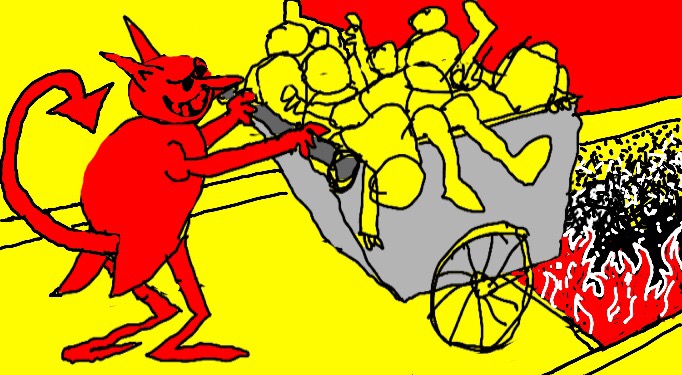

More destructive crises will probably come unexpectedly.

The present world economic system is causing harm and is very unstable.

Without change we are all going to hell in a handcart.

We are very sorry for the miserable ending.

All of us at "why it doesnt" wish that The Professor would lighten up on the economics

but he insists on his logic.

But we hope, at least, that you enjoyed the illustrations.

This website explains the mismatch

between investment and consumption

and why this has serious repercussions

for the world economy.

That is all it does. No more and no less.

It does not explain why

inequality continues to rise.

Nor does it discuss the political,

social or ecological dimensions

or what might be done.

But The Professor can help.

He welcomes you to see more of his antics

at his other website.

Click on

www.politicalart.co.uk

where he explains the consequences of inequality on the world economy.

Cartoon Gallery

Pete, sometimes known as PEET, has another website.

It is a gallery of some of his cartoons.

Click on

www.peetcartoons.com

to get to the Cartoon Gallery .

Suggestions and feedback welcome.

Please forward this website to your friends.